To Contact Us

To our page bach through previos editions click here Index is in right hand column

December 2012 Edition

Please see our latest iformation on the most disgusting NZ Feltex IPO scandal here.

Crooks Go To the Top

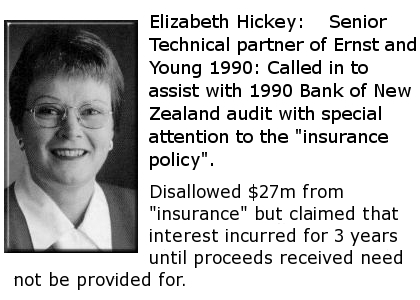

Crookedest Accountants Ever appointed to rule in 2013 Well it has happened. One of the crookest accountants ever has been made president of the New Zealand Institute of Chartered Accountants for the 2013 year. Elizabeth Hickey was Senior Technical Partner of the "big six" accounting firm Ernst and Young and she agreed in 1990 to supervise the Bank of New Zealand audit being done by fellow partner Peter Garty and share the responsibility for giving an unqualified Audit Report to accounts showing an $100m profit when she knew that the real profit, which the bank should have declared was zero or very close to it.

But that is not all. It is a double shocker because the International Federation of Accountants has for the first time elected a New Zealander as its president but that New Zealander, Warren Allen, was a professional audit partner of Hickey and Garty from June 1990 (including late 1992 when allegations concerning the the fake insurance and Ernst and Whinney in a conspiracy concerning it, were made) and is a fellow crook as well because he has wilfilly tried to cover up the Securities Commission's findings with respect to the 1990 Bank of New Zealand annual accounts.

We have two versions of the reference work we are using. There is this one with is all photographic and was scanned by the Securities Commission about 8 years ago and was available on its web site until the FMA got hold of the site. The FMA does not believe in openness. It is perhaps somewhat modelled on the KGB. Anyway this second version is a rough translation of the first one with the characters identified so that it is a smaller file which is potentially searchable. It does not contain the appendices. The page numbers we refer to are those on the manuscript, not on the viewing software.

The criminal manipulation contained in those 1990 accounts involved the mis-allocation of the fair share of interest earned for that year on two huge parcels of long term zero coupon bonds which the Bank had purchased in March 1988, no doubt with such purpose in mind. The Bank dressed up (p20&252) one of these parcels (at a cost of $1.25m) to sort of look like an insurance policy covering loan losses. The idea was the Bank could effectively allocate a large portion of the total bond interest to a given year by making an "insurance claim". The cash flow of the bond parcel remained exactly the same regardless of what "insurance claim or claims" might be made however. In 1990 the Bank made a "claim" of $94m which gave an "increment" to reported profit of $55m from this source.

At the bottom of page 151 a portion of the banks draft audit committee minutes of 11 May 1990 which includes "In this years audit review Ernst & Young have uti/isad their senior technical partner, Liz Hickey, with a full review of all the Bank's accounting policies and practices Including this policy. Ms Hickey indicated that the accounting treatment which was agreed by the auditors In financial year ending 1988 may not now be in line with emerging and developing accounting practices."

At the bottom of page 151 a portion of the banks draft audit committee minutes of 11 May 1990 which includes "In this years audit review Ernst & Young have uti/isad their senior technical partner, Liz Hickey, with a full review of all the Bank's accounting policies and practices Including this policy. Ms Hickey indicated that the accounting treatment which was agreed by the auditors In financial year ending 1988 may not now be in line with emerging and developing accounting practices."

"This policy" referred to was the Banks loss policy which of course being a fix yield investment returned the same cash at the same dates no matter what "claims might have been deemed to have been made. Ms Hickey well knew that income from such bonds had to be allocated on a Yield To Maturity basis both in 1988 and then in 1990. The author of this page in early 1988 attended the taxation update course of the NZ Society of Accountants which was conducted by people from the IRD (tax department). The course consisted almost entirely of training in the use of Yield to Maturity calculations which were then being made compulsory for interest allocation. The paper presented (which no doubt could still be found) made it clear the IRD was only "catching up" because YTM had them been compulsory for financial reporting purposes for several years. Earlier courses explaining that YTM was compulsory for financial purposes could no doubt also be found.

The other zero coupon bond was financed from a large borrowing of "perpetual subordinated capital notes" or some such name. The interest rate on these notes was variable, being tied to the LIBOR rate (a widely recognised international yardstick) and was paid twice yearly by the bank. (p184)The bonds were such that their maturity value paid off the "notes" borrowing in due course and they were held by the lender by way of the notes, as security. We think this was an example of loan defeasance whereby the two financial instruments are collectively called the notes and the net amount of borrowing was shown in the accounts. The Bank was allocating the interest on these by way of the "straight line" method which was not acceptable as Ms Hickey well knew. The Yield to Maturity method had to be used which recognises less interest in the early stages, the difference in this case being about $10m with a double digit interest rate involved. Worse still the Bank had "accidentally" failed to credit any interest for these bonds the previous year so the $16m straight line calculation for that 1989 year was put through as profit for the 1990 year. As Ms Hickey well knew it is not acceptable to do that. Readers of the accounts are entitle to an accurate statement of profitability for the year concerned only, so that they might more accurately decipher where the entity is going.

The Bank had been officially told that the auditors were utilising Ms Hickey to review all issues including the insurance policy. Similarly Mr Garty when doing the audit officially told the Bank that they were looking in to the insurance and the notes. This was not a case of things being overlooked. But they took no action to qualify their report with respect to either. Their audit notes were faked to make it look like their non-action was all unfortunate to the casual observer. We have canvassed their audit notes many times and do not wish to cover that again at the moment except to say that Ms Hickey was responsible for the audit notes concerning these two large parcels of zero coupon bonds.

Well the Bank was not climbing its way back to profitability as the politicians (we think from both main parties) who negotiated this bit of corruption possibly expected and sought to demonstrate. About 6 months after the release of the annual accounts the Bank was bailed out again to the tune of about $300m by the incoming National Government.

In June 1992 the said Elizabeth Hickey was appointed to the (Government appointed) Securities Commission, no doubt as reward for "services rendered" as stated above, and as protection from being accused of the actions as stated above.

On 23 September 1992 Winston Peters MP made allegations concerning such a "false set of accounts" in Parliament (see page 78). On 15 October 1992 the Securities Commission undertook to investigate these allegations. It made no mention of its member Ms Hickey being already deeply involved in this BNZ matter as an auditor. On 24 May 1993 the Commission released its report. The report contained extensive reference to, and some criticism of, Ms Hickey, but generally said her actions were most unfortunate, and it did not mention the fact that she was a member of the Commission. The news media has never exposed the fact that she was involved in the matter let alone being the lead auditor. Securities Commissions it would seem are always corrupt in favour of the Government who have appointed their members but the concensus seems to be that they are not quite as corrupt as the national accountancy body of the country concerned. This 1993 Commission, lead by Mr P D McKenzie, a Christchurch QC and a "bible" man by all accounts, appeared to bind the news media and indeed Mr Peters into the conspiracy.

The 400 plus page report sought to convince overseas readers that NZ had good accounting policies, ie was not a banana republic but that nevertheless nobody was responsible for this overstatement of profit. It was all an unfortunate happening according to this Commission. Lack of education was the only factor cited and that it was not. Many of us got thrown out of the Society/Institute as expensive continuing education "reforms" were introduced. Ms Hickey's then collegue Warren Allen lead the charge for this. He will tell you that the Securities Commission report said that Erst and Young did nothing wrong, which is utter nonsense. Ms Hickey claims that the BNZ audit was the responsibility of the audit partner and she had nothing to do with it because so few copirs of the report were issued and she knew where they all were. Ms Hickey of course was a top paid presenter at these education sessions because no-one was told of her "unfortunate" upon "unfortunate" involvement with the 1990 BNZ jack-up. The unwritten theory was if you are not corrupt enough to hold down a decent accounting job and so pay the education fees then you dont deserve to be a Society/Institute member.

The "Society" was closed down so that after a year nobody could be brought before it for indiscretions committed under its jurisdiction. Too many members were worried about the possbility of being called to account. It was not just a name change. But nowdays the Institute people like to think of the Society and Institute being one the same thing.

Ms Hickeys crooked involvement with the BNZ in 1990 was one negotiated with both major political parties. She was assured that she would not get into trouble for it and that is how it has proved to date. But if the law requires that an entity be audited and an Audit Report produced then that is what must be done. Anyone who just pretends to audit it and produces an unqualified report is an absolute crook and hence that is what Ms Hickey is. Integrity is the essential requirement of an accountant not education.

We come now to Mr Allen's corrupt involvement. We insert here the final page of submissions he made to the Professional Conduct Committee Of the NZ Institute of Chartered Accountants in earl 2002 in response to a complaint. Being the subject of complaints is of couse not in itself a damning matter.

We call attention to his item g which we say is 1000% dishonest. Mr Allen was a partner in the BNZ's auditor in 1987 after the sharemarket crash and as a keen auditor must have been interested in how tough the firn was going to be on loans valuation for clients such as that bank. In Setember 1992 he must surely have been keenly interested in the allegations made against his new and old firm by Winston Peters MP in Parliament. As a partner he must have been keenly interested in the response of his firm to the Securities Commission and on the effects on his firm of the Commissions report and on how it might be modified. He must also have been very interested on what this very large report had to say about his firm and the three or so partners and former partners directly involved. There is no possiblity that he did not know what the Commission had to say about his firm's audit, and what it said is the complete opposite of what he says in his item g. At page 189 of the Securities Commissions report this is said "

F.Our findings In relation to the performance of Ems! and Young

E & Y gave an unqualified audit opinion with respect to a set of financial statements for the BNZ for the year ended 31 March 1990 which did not, in our opinion, present a true and fair view of the results of the Bank for that period."

15.154 Mr Allen had a clear duty to check up upon what the Commission said if he were in doubt but there is no way that he could have thought that what he said was true. He was working on knowledge that this finding was not reported in the Press and circulation of the document was minimal.

Let us change tact and mention Ross Asset Management. Mr Ross was apparently given a Financial Advisors certificate by NZ's relatively new Securities Commission called the Financial Markets Authority (it is a member of the International Organisation of Securities Commissions). Now complaints had been made about Mr Ross to the old Securities Commission But the FMA could not investigate them to see if Mr Ross deserved a certificate. Oh No. The corrupt old Securities Commission gave false bills of health to the likes of Feltex Carpets at the "request" of the National and Labour parties. This was so these parties could steal and cheat for their own purposes.

A good thing the Securities Commission did was put its reports (dating back to the 1980s) on-line where they could be criticised or whatever but the FMA has put paid to that and dumped the lot.

The FMA was to take over from the Securities Commission but not revisit anything that the Securities Commission had done. Hence Investors lose about $400m. Well arguably one is mad putting money into an organisation that does not have any audit reports but as we suggest above what is the use of audit reports if nobody goes to jail for wilfully producing false ones. The dealings of the old Securities Commission must be investigated. They have killed Paul Phillip Wilson and David Patrick Gaynor and probably many others.

to top of page