The 1990 Bank of New Zealand annual accounts -and- The 2004 Feltex Carpets Initial Public Offer

|

These documents are the subject but let's go back a bit |

|

| The bank was fully government owned from 1945 until the mid 1980s | Feltex was a listed public company manufacturing carpets in NZ in the 1970s and early 80s |

|

Background |

|

| The BNZ was formed in 1862 and got Goverment business soon after. Moved head office here in 1901 and the Bank was nationalised in 1945. | We suspect Feltex benefited greatly from the CER agreement with Australia in the late 70s, gaining a significant share of that carpet market. |

|

Entrepreneurs change things |

|

| After the 1984 government change eminent corporate raider Ron Brierley was appointed BNZ chairman |

In the mid 1980s high flying investment company Equiticorp bought Feltex Carpets Ltd |

|

||

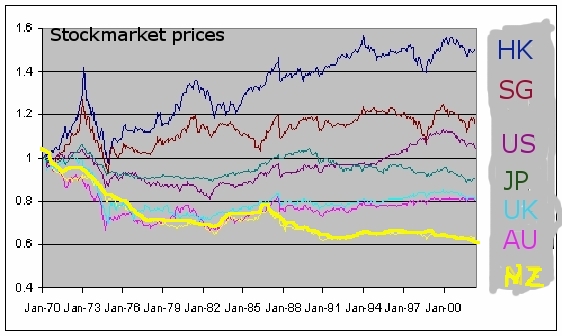

| The stockmarket bubble and crash is relevant to both stories. Inappropriate lending by the BNZ probably contributed to a large bubble in NZ ending with the Nov 87 crash. This graph shows indices adjusted for inflation. |

|

changes |

|

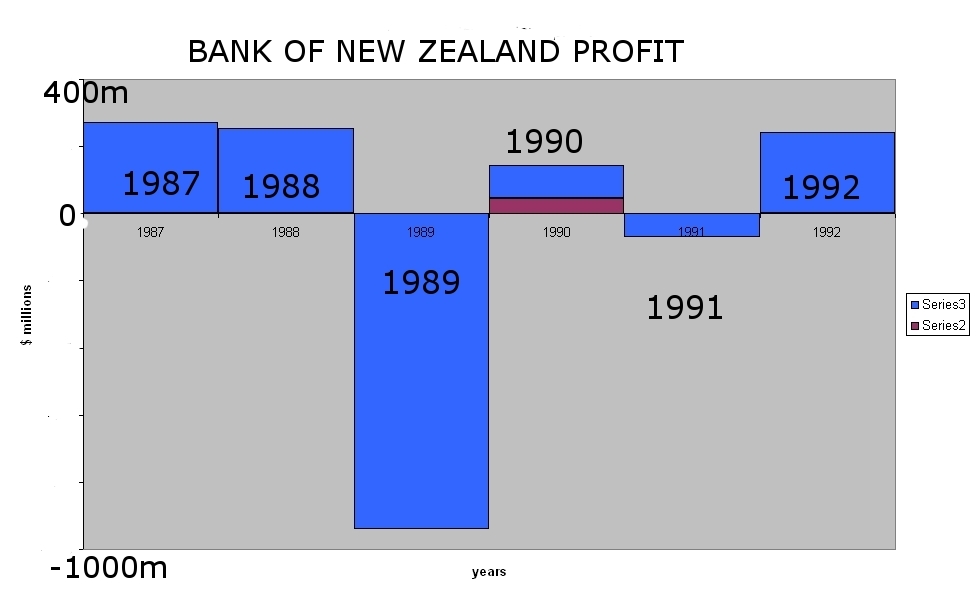

| The 1988 bank profit showed only a minor profit decline despite the crash 4 months earlier. | Equiticorp was liquidated following the 87 crash and Feltex in 1996 found itself owned by an offshoot of Swiss corporate giant Credit Suisse. |

|

the effect of time |

|

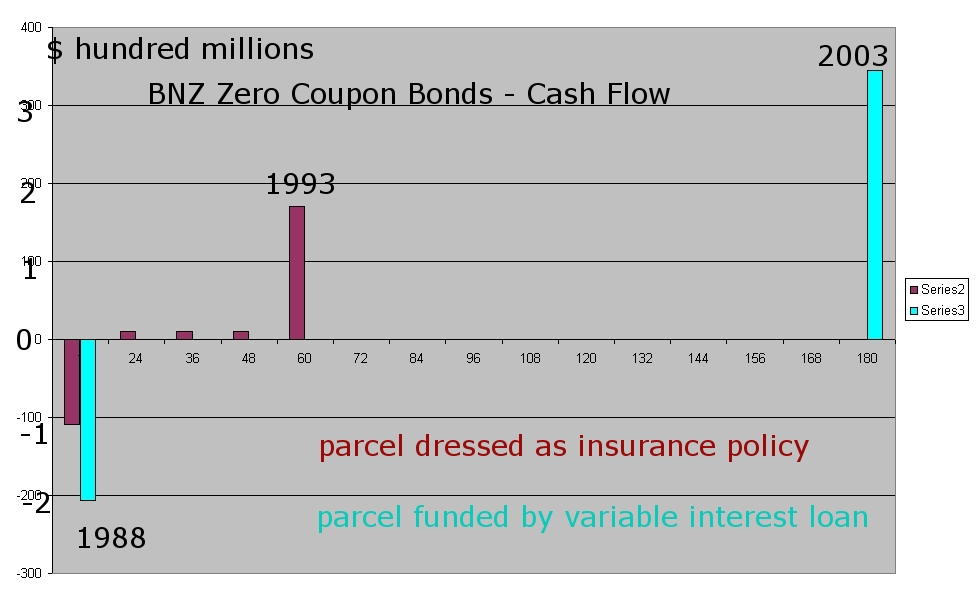

| BNZ bought two huge zero coupon bond parcels on 31 March 1988. These are the cash flows of each. | But protection for this industry was steadily diminishing in both Australia an NZ. |

|

changed around |

|

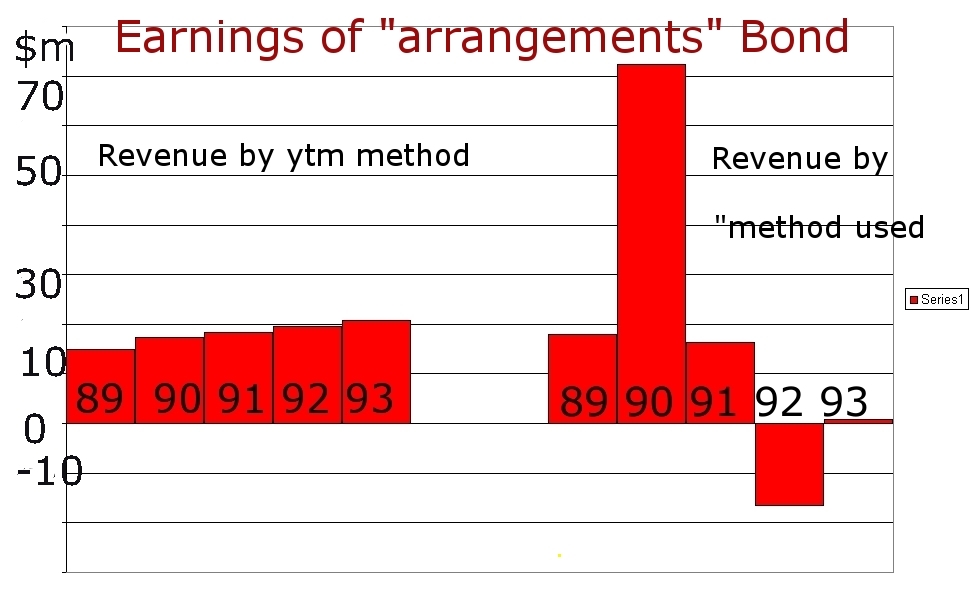

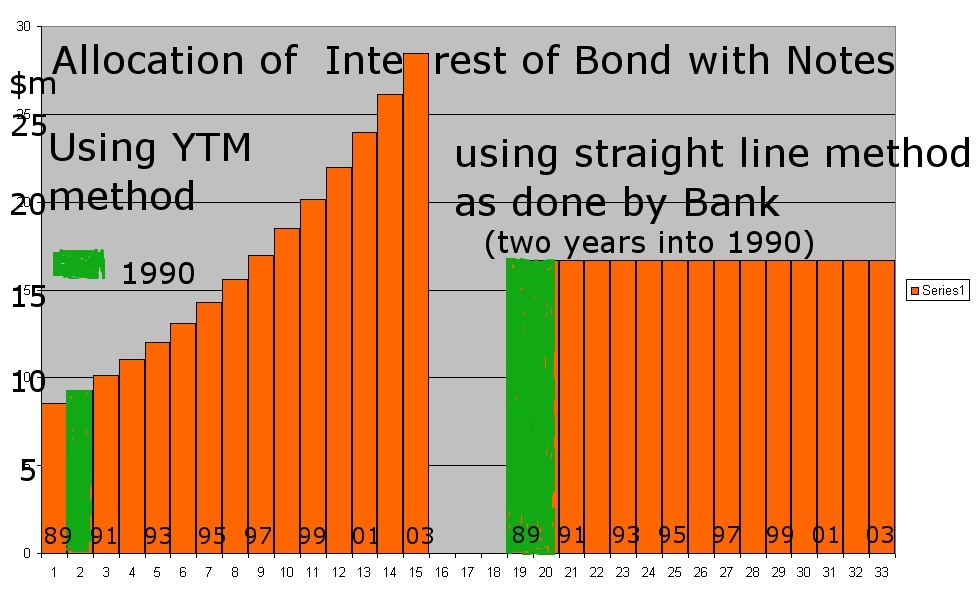

| The revenue from one of the bond parcels was applied as on the right when it should have been by YTD as on the left. | In 2000 Feltex brought Melbourne Australia carpet factories from Shaw Industries, the world's largest carpet manufacturer who wished to exit Australia. Not a surprise given the change in tariff policy. We think they jointly planned for Credit Suisse to get out too. |

|

There are good and bad influences in the stories |

|

| It is understandable that some people partially in the know such as Winston Peters MP thought that this bond dressed like an insurance policy had been used to justify the declared profit for 1988, but it seems this was not so. | Sam Magill of the purchased Shaw operation became Fetex's managing director. We think that there was an agreement that Shaws would go easy on exporting into Australasia until Feltex was "offloaded". |

|

sky high |

|

| And similarly with the other zero coupon bond parcel 1990 revenue declared was triple what it should have been. 1989 revenue was lumped in with it. | Credit Suisse refurbished these New York offices it owns using high quality Feltex wool carpet. It had the capacity to support Feltex when it wanted to. |

|

shifty associations |

|

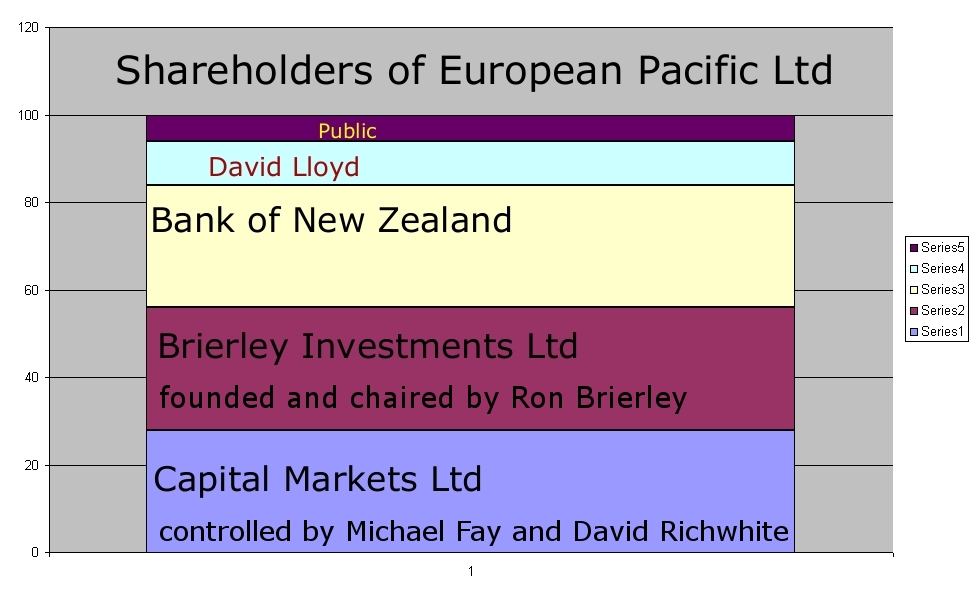

| The idea of the for "smoothing" of reported profits purportedly came by European Pacific Ltd partly owned by the Bank with more controversial entities. | A large share broking business under the Credit Suisse First Boston name was set up in NZ in the 1990s. In November 2000 it represented both parties to this $0.5m sham share deal which robbed ACC. The CSFB name changed to First NZ Capital a little later. |

|

cre dib il ity ? |

|

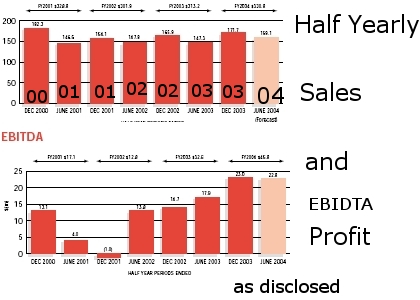

| Well a bail out by the Government of nearly $1b was undertaken midway though the 1989 year. Booz Allen Hamilton were appointed to see that receivables were properly valued in future. After the 1989 result was announced there were changes with Americas Cup heroes Fay Richwhite's public company Capital Markets taking a shareholding. | These graphs show that profitability after the Sydney Olympics of 2000 was woeful but picked up quite well. The pick up in 2003 despite falling sales is disputed in several quarters. |

|

|

|

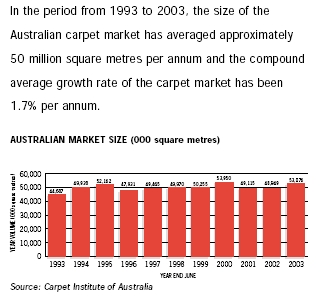

| Dr Robin Congreve was appointed a director by in June 1989. In 2007 Dr Congreve received a "Distinguished Alumni Award" along with the Telecom executive who lost her job and seems not to have found another one, from Victoria, arguably NZ's crookedest university. | The above is an unaltered extract from page of the 5 May 2004 Prospectus document. 1.7% per annum does indeed increase the 1993 figure shown to the 2003 one. But 2003 is an exceptionally low year, the three preceding years at least being higher. The years 1995 to 2002 would indicate quite a fall. And the graph is of carpet made available to the market which takes no account of changes in stock levels. It thus does not represent sales. |

|

The grab |

|

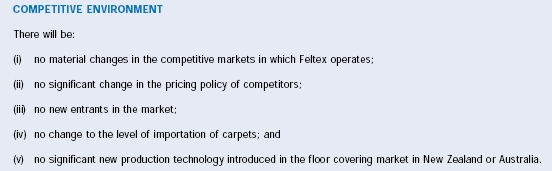

| We should also mention Dr Congreve's richlist colleague Geoff Ricketts who joined the BNZ board at the same time. They hunt together with Oceania and Eastern Holdings these days. These two and Michael Fay were sued by Levin businessman Donald Kincade over insider trading of BNZ shares with some success. He recently got an award from Auckland University. Universities seem prepared to make awards to common thieves if they have money. | More significantly the prospectus contained unrealistic assumptions concerning competition from imports. This extract from page 88 shows no realization of the effect of lowering tariffs |

|

There they are |

|

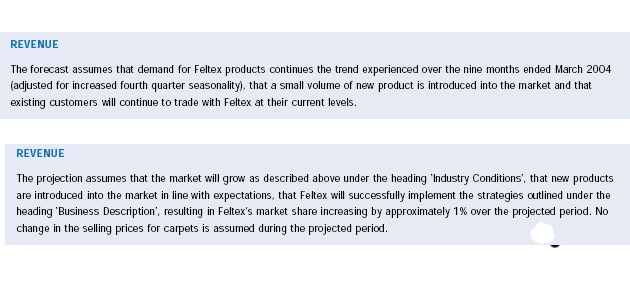

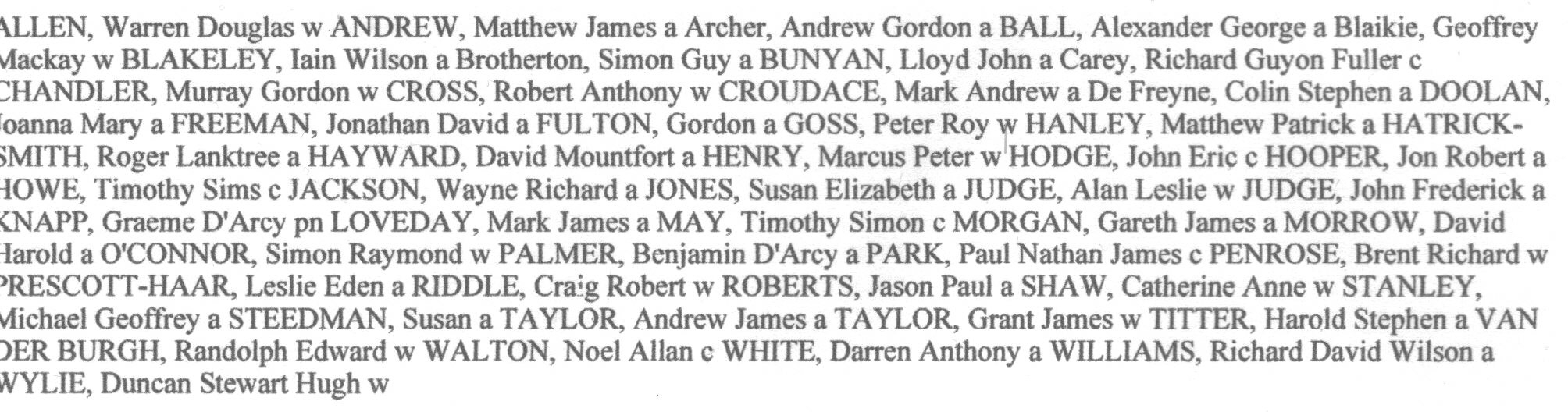

| Well the whole gang (elsewhere called the board) of 1990 needs condemnation. They knew the profit statement had to be an accurate statement of what was earned in the year and there was no place for "smoothing" what was reported. An up to date photo may be available prison muster at some future time. | But the worst is probably in these two clips from pages 89 and 91 respectively where they refer to a rise in market share within the past 9 months which is a most short interval and to having some marketing magic up their sleeve. The 1% has no genuine justification and -5% reflects what has been happening as competition from cheap labour countries is faced. Realism is absent. |

|

big figures |

|

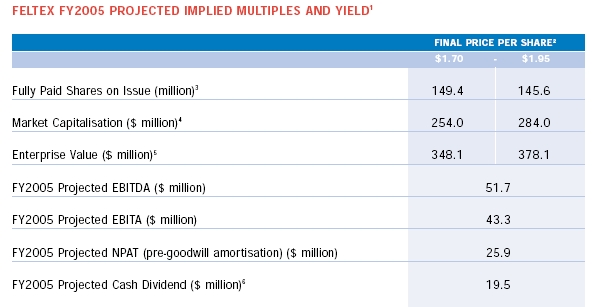

| Hon David Caygill agreed to the release of the 1990 accounts without disclosing that he had been asked to bail out the BNZ a second time because of losses due to the delayed decline of the Australian property market. There were no Post Balance Date disclosures as such in the accounts as is required. The shares remained overvalued. | The profit projections for 2005 formed a backbone to the case for subscribing to the issue as shown here. The prospectus was a gross misrepresentation of the state of the company for the benefit of the vendors. |

|

more of them |

|

| We think certain BNZ accounting staff need to bear some responibility for the fraud. Perhaps they were responsible for the evential enquirey but they should have been able to stop the accounts being issued by speaking out. | The two Lead Brokers were apparently involved in the preparation of the prospectus. The chairman of Forsyth Barr, Eion Edgar FCA, was well qualified to see the scam for what it was. He was also chairman of of the ACC Investments. Other institutions claim to have seen red with respect to Feltex but not ACC which forked out $9m for shares. |

|

under- ground aspects |

|

| Well that covers the deceit and who was responsible but the Fay Richwhite camp sold the National Provident Fund we think $100m soon after. We say this was pure robbery. No attempt was made to recover the funds. | And head of the firm with the Credit Suisse connections was we believe Bill Trotter. Mr Trotter apparently narrowly missed getting interred in a forest park a little time before the Feltex issue. |

|

Who could have or should have prevented these raids? |

|

| No prizes for guessing who the audit firm was in both cases. | We believe they are geared up for the advancement of American economic colonialism. |

|

Then and now |

|

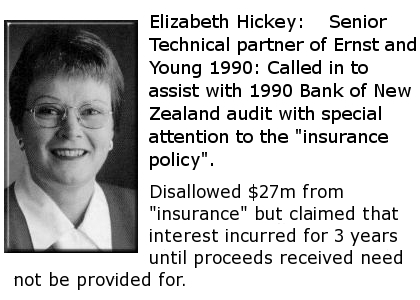

| Mr Garty then "found" items of profit understatement to offset the $27m. After the accounts were relaesed he told the Bank they were just "possible" understatement items. | Accountants are supposed to be independant but there is good evidence to believe that the EY partners are not ensuring that this is so. |

|

variations |

|

| Mr Garty introduced an unders and overs schedule and "found" items of profit understatement to offset the genuine overstatement. A little later he told the bank they were just "possible" understatement items. | But the New Zealand chairman is photo shy and the NZ partners are identity and web sensitive. |

|

disclaiming |

|

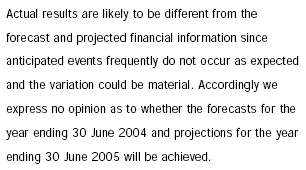

| Ms Hickey was a technical expert who knew that tricks involving low coupon bonds were declared to be over. We believe she well knew that the bonds associated with both the "insurance" and the "notes" were being used to overstate profits but she was being assured by polititions that she would not get into trouble, which was duly honoured with high profile appointments. but that is no excuse and jail is still were she should go. | The above paragraph is contained near the end of the prospectus. E&Y claim that the first sentence just explains why they have not expressed an opinion. We say it also implies that they have assessed the situation and determined that there are not more significant reasons for not doing so, which was not the case. Their reason is applicable to all such forecasting but they refer to the Feltex forecasts specifically. The implication is they give the most relevant reason according to the situation as the find it. It is the opinion they say they have not done, not the audit. |

|

notes |

|

| The notes package consisted of borrowing at a variable interest rate and purchase of a zero coupon bond which would pay off the pricipal borrowed on due date. Mr Garty purports to have realised in 1991 that the interest was zero but still "thought" the zero interest bonds was borrowing not an investment and so there had been a profit understatement. We say these experts at all times knew the exact nature of the package and conducted a fraudulent play-act. | There is this good evidence from the Securities Commission that reports E&Y gave to the Feltex board around the end of 2005 were substandard. Feltex was well in the news at that time so there is no resond to think such practice was an accident or started then. |

|

tie ups |

|

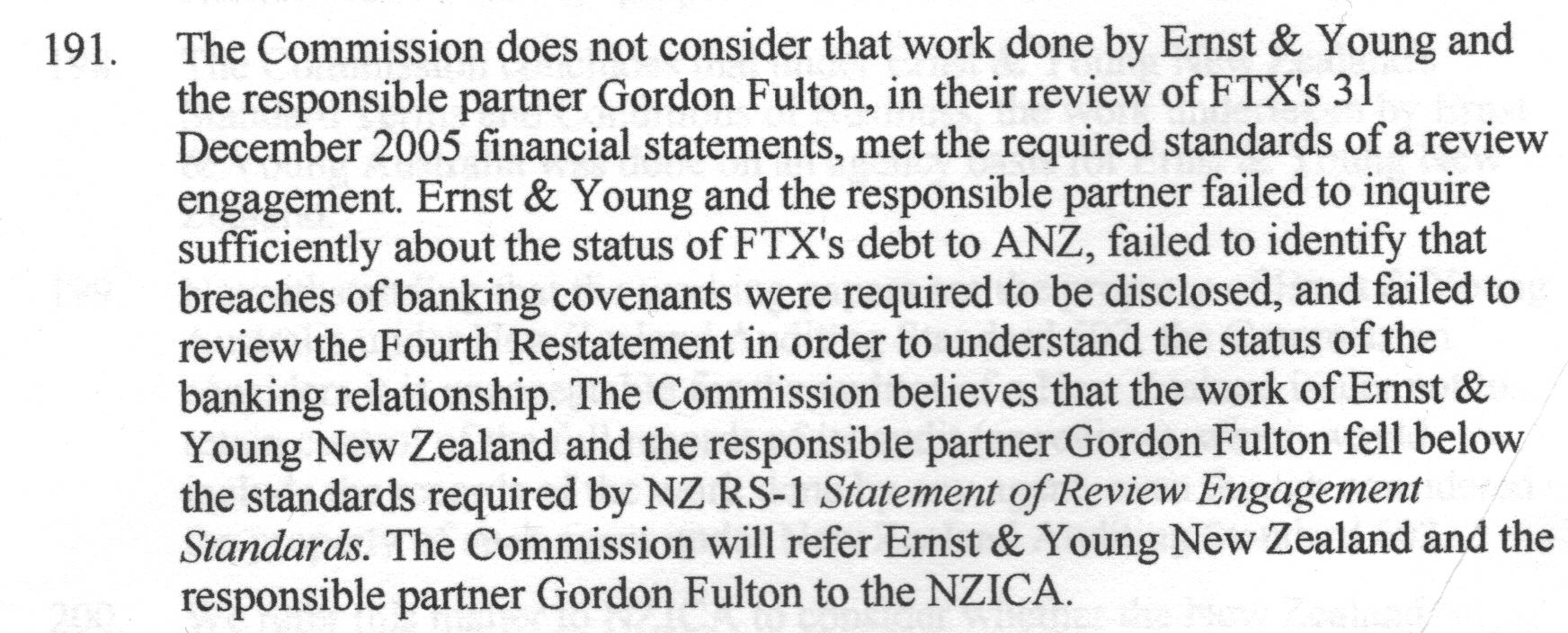

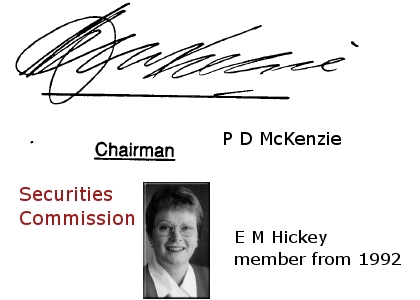

| Securities Commission Chairman P D McKenzie and members R E Baker and R A Anderson, were the quorum involved in the production of a 397 page report on the matter, released in May 1993. But outwardly at least it at least it was the report of the Commission not the quorum. Ms Hickey was a member of the Commission and was at the very centre of what was being investigated yet this was not disclosed. We say such disclosure is required standard practise because it is hard to condenm one's colleagues and and it reduces the possibity of a member keeping secret their association with a matter being reviewed. | Securities Commission chaired by Jane Diplock issued a one page report on the matter on 26 August 2006. It found no breaches and said that no further Action would be taken. Despite that it issued a further report on 11 October 2007 containing 2 1/2 pages on the IPO. It retained as its accounting expert, one Kevin Simpkins, a former National Head of Accounting of Ernst and Young. David Jackson is and was a member of the Commission when these reports were issued and conveniently was an Auckland Audit Partner of Ernst and Young when the Feltex IPO was "audited" by them. No declaration of interest was contained in the reports. We think Messrs Jackson and Simpkins will have been conpempory partners. |

|

notes |

|

| These are the worst of the wrong bits.The income overstatement on the capital notes was at least $22m because there is no justification for treating undecleared 1989 income as 1990 income. But more importantly we say the failure to record the profit understatement was not an unfortunate error but a wilfully pretended "mistake". The "mistakes" have a Michael Fay flavour about them. And the profit understatement items were invented and not genuinely misconceived. The Commission did not even discuss the possibility of this in its report despite massive evidence. We believe Ms Hickey has been told by both political parties that if she feigns mistakes to result in an unqualified audit report they will look after her and look after her they did with a record term on the Securities Commission, FRSB and ASRB chairpersonships, appointments to SOE boards, an Order of NZ award, and then a negotiated top position with the IASB in London. Mr Garty had a protected job at Telecom, which held a monopoly position at the Government's pleasure. but such rewards are no excuse and the Commission had a duty to say that the 1990 BNZ audit was wilfully false. | The Commissions interpretation of realism is pathetic. It ignores Feltex's calculation of market growth (P37) by taking the difference between the lowest and second highest of fluctuating annual figures. The have not ascertained what Feltex's history of market share has been and have not thought about the effects of tariff changes in its countries of residence. The 1% market share increase was ridiculous. Interviwing personnel is a useless prime investigation tool. They get charmed to bits. They recognise only misdeeds that occur after Oct 2005 because they do not want to upset there auditor colleague David Jackson or the director Joan Withers who we think accepted a board place so that the gender composition might appeal to the Mum of the Mum and Dad victims. Ms Diplock has an objedtive of getting company boards to be equal in gender numbers as the commission is or was. The Commission has ignorred the auditor's disclaimer which gives the impression that if there was a more sinister reason for not expressing an opinion on the Feltex projections the auditors would have given it. Why did they not find the Feb 2005 sales that Mr Tony Gavigan thinks were included in the reported sales to 31 Dec 2004? |

to top of page

To Contact Us Index is in right hand column

Justaccounting late mid May 2008 Edition ---- to page back through Previous Editions click here

Site Index

Accident Compensation Corporation 1Accounting Contractor 1

Accounting Supremos 1

Nicholas Bagnall 12

Bank of New Zealand 1990 annual report1

David Caygill 12

Cliff Cook 1 2

Credit Suisse First Boston 1

David Cullwick 1

Jane Diplock 1

Dominion Post 1 23

Brian Easton 1

Eion Edgar 12

Ernst & Young 12 3

Feltex ipo 1 2 3

Feltex liquidators 1 2

Kenneth Fergus 1

Peter Fitzsimmonds 1

Gordon Fulton 1 2

Peter Garty12 34

Tony Gavigan 1

John Hagen 12

Elizabeth Hickey 1

Housing Corporation 1

David Jackson 1

Trevor Janes 1

Kerry McDonald 1 234

Gary Muriwai 1 2

National Mail Ltd12

Niven Robinson 1

New Zealand Institute 1

NZICA Prof Conduct Com1

NZ Press Council 1

Mark Prebble 1

Securities Commission 1 2 3 45

Ian Silver 1

Spacetable 12

Marta Steeman 12

Tranz Rail book build12

Don Trow 1

Keith Wedlock 1

Joan Withers 1

Advertising section

We link to: Accounting Page - Comprehensive Accounting Resources and Directory.Internet Web Directory - The internet's fastest growing directory of the best web sites. Fully searchable and updated regularly. We Advertise:

Books

Case studies of ICANZ coverups 2 Ernst and Young report to Dairy Co shareholders

Pokemon

Gifts

Cars

Toys

MP3

Videos

Dolls

Garden tools

Jewelry

------------------------

Structure and Operation of an alternative Accounting Organisation designed to shun dishonesty.

Suitable Objectives

Register of Members

Members Forum - Topical * open to all meantime: Plenty of Opinion

Magazine Plans

Need an Accountant? or Prepared to Change?

Users Forum * have your say

Ready to Join?Offering some Help?

Knowledge Tests * being developedInformation Bulletins

Why it is being Proposed

What's Wrong with the existing accounting body?

So called BNZ Auditan extensive case study Current Attitudes of Existing Institute

Visit our Advertising page from

Here